Exploring the 2025 Child Tax Credit and Its Benefits for Families

In the dynamic world of personal finance, families often find themselves navigating a maze of options designed to support their financial well-being. With numerous initiatives aimed at easing the burden of raising little ones, understanding available allowances can significantly impact a household’s budget. These incentives can help parents manage expenses while ensuring a bright future for their offspring.

One area that has garnered attention is the assistance provided to assist families raising young dependents. Whether it’s covering everyday expenses or saving for education, these financial perks can make a substantial difference in the lives of many. With changes made to regulations and the introduction of new benefits, staying informed is crucial for making the most out of what’s available.

As families plan for the future, knowing what resources are at their disposal is essential. With the right knowledge, parents can leverage these opportunities effectively, fostering a secure and prosperous environment for their loved ones. In this section, we’ll delve into upcoming adjustments and what they mean for households everywhere.

Understanding the 2025 Child Tax Benefit

When it comes to navigating the financial landscape of raising a family, knowing the benefits available can make a significant difference. One intriguing aspect is the support system that aims to alleviate some of the burdens parents face in today’s world. It’s all about providing a little extra help to families, making sure they have more resources at their disposal as they care for their loved ones.

Let’s break it down: This particular assistance is designed to offer financial relief to guardians, ensuring that they can manage their expenses more comfortably. The aim is to boost the well-being of families, allowing them to invest in their children’s future without feeling overwhelmed by costs.

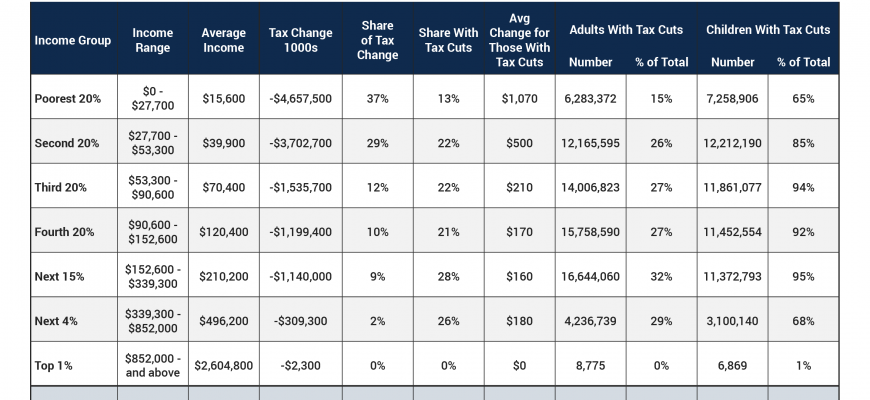

Eligibility is key. Understanding who qualifies and how benefits are calculated can empower families to take full advantage of these resources. Various factors come into play, including income levels and how many dependents a household has. It’s important to stay informed about changing guidelines that could affect accessibility.

Overall, this initiative represents a commitment to supporting parents in their journey, helping to foster a nurturing environment for children to grow and thrive. By staying updated and aware, families can make informed decisions and maximize their potential benefits.

Eligibility Criteria for Financial Assistance

When it comes to receiving financial support aimed at families, understanding who qualifies is crucial. Various factors can determine eligibility, such as income levels, family size, and specific circumstances related to each household. It’s important to know these details so you can navigate the process effectively and ensure you don’t miss out on any available resources.

Firstly, your income plays a significant role. Generally, there are predefined income brackets, and staying within these limits is essential. Additionally, the number of dependents in your household can influence the level of assistance you might receive. Larger families often have different criteria than those with fewer members.

Moreover, other factors like marital status and residency can also impact eligibility. For instance, whether you’re single, married, or living alone can change the dynamics of qualification. The same applies to where you live; certain regions may have unique guidelines or additional benefits based on local policies.

Finally, it’s always wise to stay informed about any updates or changes to the eligibility guidelines, as regulations can shift from year to year. Keeping an eye on official announcements or consulting with a tax professional can ensure that you are prepared and informed. Understanding these qualifications is the first step in taking advantage of the financial support available to you.

How to Claim the 2025 Credits

Navigating the process of securing financial assistance for your little ones can feel overwhelming. However, understanding how to access these benefits can alleviate some of that stress. Let’s break it down step by step to simplify the journey.

First, gather all necessary documentation that supports your eligibility. This usually involves personal identification, proof of residency, and any relevant financial records. Having everything organized will make the application process much smoother.

Next, determine the appropriate forms to fill out. This may vary based on your situation, so be sure to check guidelines provided by relevant authorities. Most forms can often be completed online, saving you time and effort.

Once you’ve submitted your application, keep an eye on its status. You may receive communications or requests for additional information, so make sure to respond promptly to avoid delays in approval.

Finally, once you’ve been approved, plan how you’ll utilize these benefits. Whether it’s for education expenses, healthcare, or everyday costs, smart planning can enhance the positive impact of this assistance.