Exploring the Income Limits for Savers Credit in 2025

When it comes to setting aside funds for the future, navigating the various systems of support can feel overwhelming. Many individuals are eager to take advantage of available programs designed to enhance their ability to save for retirement, but understanding the guidelines and thresholds in place is essential. Various initiatives aim to encourage and reward those who make an effort to secure their financial well-being in their later years.

Grasping the essentials of these support mechanisms can significantly influence your saving strategy. It’s not just about how much you save, but also about knowing where you stand in relation to specific benchmarks set by regulations. These provisions offer opportunities that can make a substantial difference in your long-term financial health, particularly for certain populations.

As you explore your options, it’s crucial to stay informed about the parameters that define eligibility for these financial advantages. A deeper understanding will not only empower you to make smarter choices but will also help you maximize the benefits designed to support your retirement ambitions. Let’s delve into the important aspects of these provisions and what you need to know to make the most of them.

Understanding Savings Incentive Basics

Grasping the fundamentals of financial encouragement programs can significantly enhance your ability to save effectively. These initiatives are designed to bolster individuals’ efforts in setting aside funds for retirement or long-term goals, providing opportunities for tax advantages. Knowing how these benefits operate will empower you to make informed choices about your savings strategy.

To start, it’s essential to recognize that there are various factors at play when considering these programs. They often involve qualifications based on personal finances, ensuring that assistance is directed where it can be most beneficial. Understanding these criteria not only helps you determine eligibility but also highlights the importance of planning ahead.

Ultimately, maximizing these incentives can lead to a more secure financial future. By taking the time to learn about available programs, potential participants can unlock valuable resources that promote healthier saving habits. Stay informed, and don’t hesitate to reach out for guidance to navigate through the options that best suit your needs.

Thresholds for Eligible Individuals

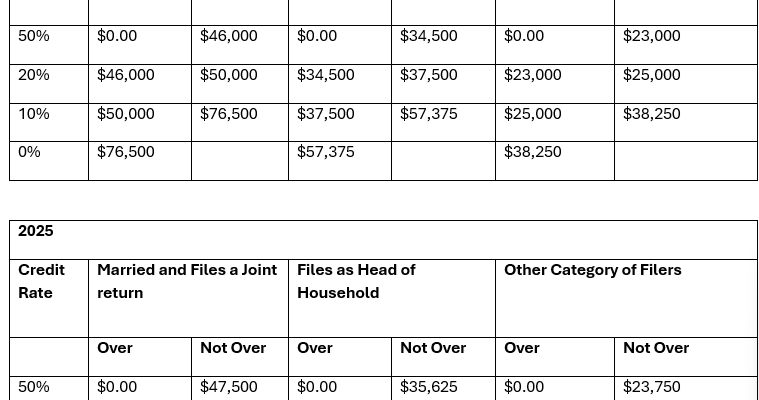

Understanding the financial parameters that determine qualifications for certain programs can be quite essential for many individuals. These thresholds often reflect the maximum allowable earnings that can affect one’s ability to benefit from various incentives. It’s crucial to know where you stand relative to these amounts to maximize potential advantages.

Different categories of individuals, such as single filers, married couples, and heads of household, often have distinct thresholds. This categorization ensures support reaches those who truly need it. Awareness of these distinctions helps applicants navigate their eligibility more effectively and plan for their financial futures accordingly.

By keeping track of earnings and familiarizing oneself with these parameters, individuals can better assess their standing and make informed decisions. Ultimately, this knowledge can empower more people to take advantage of available programs, leading to enhanced financial stability and growth.

How to Maximize Your Savings Benefits

Making the most out of your financial resources is essential for building a secure future. It’s all about being strategic with your funds and finding the right opportunities to enhance what you can save. Whether you’re just starting out or looking to expand your savings, there are several approaches you can take to ensure you’re getting the most bang for your buck.

First and foremost, educate yourself on available programs. Many initiatives are designed to help individuals like you boost their savings. Understanding the various offerings can lead to better-informed decisions and enable you to take full advantage of incentives that may apply to your situation.

Consider setting up automated contributions. By automating your deposits, you make saving a seamless part of your financial routine. This not only instills disciplined savings habits but also prevents you from spending money that you intended to save.

It’s also wise to keep an eye on your expenses. Regularly reviewing and adjusting your budget can uncover areas where you might cut back. Redirecting these savings into your savings account can significantly boost your total over time.

Lastly, don’t forget about interest rates. Research accounts that offer higher yields. This small change can make a huge difference in the growth of your savings. The goal is to let your money work for you, and selecting the right account is a fundamental step in that direction.