Understanding the Benefits of the 2025 Savers Credit for Future Financial Planning

When it comes to building a secure financial future, understanding various incentives is key. Allowing individuals to enhance their savings while benefiting from potential governmental assistance can significantly influence long-term wealth accumulation.

Many people might not realize that there are programs designed to encourage the habit of saving. These initiatives can serve as a substantial boost for those looking to put away funds for retirement or other life goals. By making informed choices, you can take full advantage of these beneficial schemes.

In this article, we will unpack the details surrounding these savings initiatives, exploring eligibility requirements, benefits, and strategies to optimize your contributions. Whether you’re a seasoned saver or just starting to learn about saving options, there’s something valuable for everyone.

Understanding the 2025 Savers Credit Benefits

When it comes to building a secure financial future, there are various incentives designed to encourage individuals to save for retirement. One particular initiative offers substantial advantages for those within certain income brackets. This initiative aims to provide a helping hand, making it easier for people to bolster their retirement savings, thus ensuring peace of mind during their golden years.

First and foremost, this program is targeted towards low to moderate-income earners, allowing them to receive a noteworthy boost in their retirement contributions. By understanding the parameters that qualify individuals for this initiative, one can take full advantage of the opportunities available. The increased savings not only provides immediate financial relief but also lays a solid foundation for one’s future.

Additionally, the benefits extend beyond the mere increase in savings. Participants may find that engaging with this initiative promotes a sense of responsibility regarding their financial health. It encourages individuals to focus on long-term goals and fosters a culture of saving that can have positive ripple effects throughout their households.

Moreover, this program has the potential to significantly reduce the overall tax burden for those who qualify. By offering a reduction in tax liability related to retirement contributions, individuals can keep more of their hard-earned money and allocate it towards other essential expenses or savings goals. This not only alleviates financial pressure but also encourages prudent fiscal habits.

In summary, tapping into this unique supportive measure can be a game-changer for many. By understanding the numerous advantages, individuals can make informed choices about their financial futures and harness the power of smart saving strategies.

Eligibility Requirements for Retirement Savings Incentives

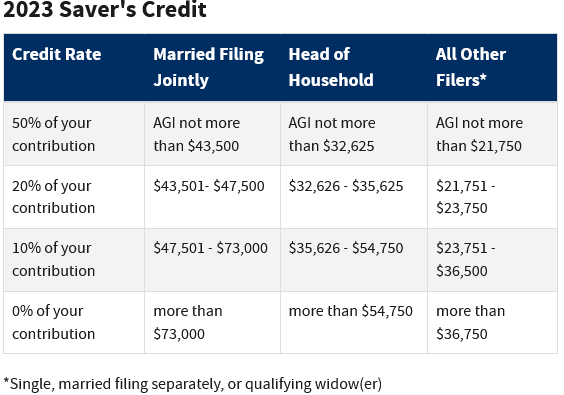

When it comes to receiving financial benefits for your retirement contributions, understanding who qualifies is crucial. Various factors come into play to determine eligibility for these programs, ensuring that they assist those who need it most. It’s not just about how much you put away; income levels, filing statuses, and other elements will significantly affect your chances of receiving support.

First things first, your income is a defining factor. Typically, there are limits based on your adjusted gross income, and exceeding these thresholds could disqualify you. Next, your tax filing status also matters. Whether you file as single, married, or head of household can influence your eligibility significantly. Additionally, you’ll need to be of a certain age or status to qualify, making it important to keep your personal circumstances in mind.

Lastly, the type of accounts you save in can play a role. Contributions made to specific retirement accounts are often required to qualify for these benefits. Being well-informed about these requirements can help you better plan your contributions and maximize any potential assistance you can receive.

Maximizing Your Savings Through Tax Benefits

When it comes to growing your finances, understanding available financial incentives can make a significant difference. Many individuals are unaware of the opportunities that exist to enhance their savings through various governmental programs designed to minimize tax liabilities. Leveraging these advantages can empower you to reach your financial goals more efficiently.

One of the simplest ways to boost your savings is by exploring refundable incentives aimed at lower or middle-income earners. These programs are crafted to support those who are striving to build a stable financial future. By taking advantage of these schemes, you not only lighten your tax burden but also create a valuable cushion for unexpected expenses.

Moreover, it’s vital to educate yourself about eligibility criteria and the various options available. Each initiative has its requirements, and grasping these nuances can significantly enhance your financial strategy. Maintain detailed records of your contributions and expenses, as they can be useful when claiming these advantages come tax time.

Additionally, consider consulting a tax professional. They can provide personalized guidance and help you navigate the complexities of financial incentives with ease. This proactive approach ensures that you are not leaving potential savings on the table.

Ultimately, taking the time to understand and utilize available financial advantages translates to real gains in your savings. Make it a priority to stay informed, and watch your hard-earned money grow.

You’ve got such a unique style;and it really shows in this video! Absolutely fantastic.