Exploring the Role of a Private Credit Analyst in 2025

In an ever-evolving economic landscape, the role of professionals focused on personalized investment assessments is becoming increasingly critical. As industries transform and financial opportunities grow, the individuals tasked with navigating these complexities are set to flourish in their careers. This section will explore the emerging trends and challenges that these specialists will face in their professional journeys.

Understanding the Dynamics of this field requires an appreciation for the broader financial environment, including emerging markets, regulatory changes, and evolving investor interests. Those engaged in this line of work must be equipped with analytical skills, creativity, and in-depth market knowledge to succeed.

Moreover, new technologies and innovative strategies play a pivotal role in shaping the skills needed for success. As the demand for tailored financial solutions rises, so too does the necessity for professionals who can think outside the box and deliver exceptional insights.

Understanding the Role of Specialized Finance Professionals

In today’s complex financial landscape, there exists a category of specialists who dive deep into assessing and managing the lending landscape. These professionals play a crucial role in evaluating opportunities that lie outside traditional banking. By analyzing various factors influencing investment prospects, they help organizations make informed decisions about resource allocation.

One of the primary functions of these finance experts is to thoroughly evaluate the profiles of potential borrowers. This entails examining financial statements, market situations, and even the management teams behind businesses. Their insights are essential in determining the creditworthiness of entities, ensuring that funds are allocated to those with the highest potential for success.

Moreover, they collaborate closely with portfolio managers, providing critical assessments that guide strategic investment choices. By closely monitoring economic trends and shifts in market dynamics, they can mitigate risks associated with lending, thereby safeguarding the interests of their organizations.

Ultimately, these finance professionals bridge the gap between investors and businesses seeking funds, fostering an environment where capital can flow effectively, and innovation can flourish. Their expertise not only supports individual companies but also enhances the overall stability and growth of the economy.

The Growth of Alternative Financing Market

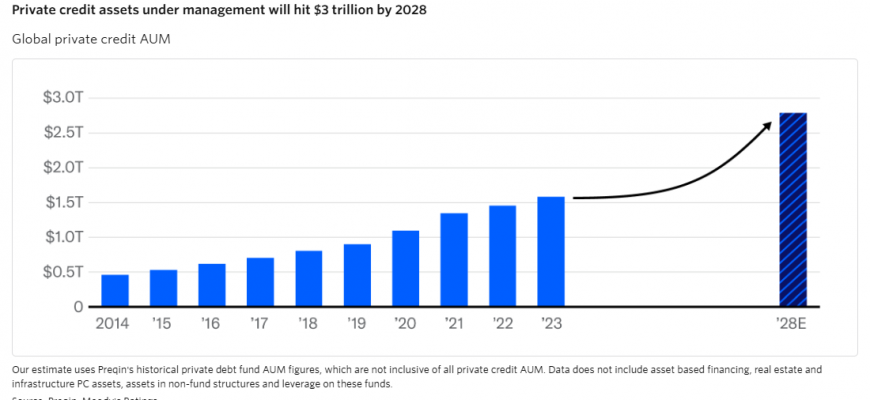

In recent years, we’ve seen a remarkable shift in the way companies seek funding. This transformation reflects a burgeoning appetite for innovative financial solutions that cater to diverse business needs. More and more firms are exploring avenues that go beyond traditional bank loans, leading to an exciting evolution in the landscape of capital allocation.

This surge in interest can be attributed to various factors. For one, many businesses find themselves in urgent need of flexible and quick funding options that conventional lenders may not provide. Additionally, as investors seek higher yields outside of standard equity markets, they are increasingly turning their attention to these alternative financing sources, finding attractive opportunities in them.

The landscape is rapidly changing, with a wider array of institutions stepping up to fill the gap left by traditional sources. Large asset managers, smaller niche firms, and even direct lenders are striving to get a piece of the action, driving competition and innovation. This dynamic environment is not only reshaping how companies finance their operations but also how investors approach risk and return.

What stands out is the inclusivity of this growth. Startups and established enterprises alike are benefiting from the expanding options available to them, allowing for more tailored financial solutions. As this sector continues to mature, we can expect further developments that will enhance accessibility for businesses across all stages of growth.

Ultimately, the upward trajectory of this alternative financing space indicates a broader trend towards diversification in funding sources. Companies and investors are embracing more varied strategies, leading to a more resilient and adaptable financing ecosystem.

Essential Skills for Success

As we look towards the evolving landscape of finance, certain abilities are becoming increasingly vital for professionals aspiring to thrive in their careers. The ability to navigate complex financial environments, assess risks, and make informed decisions will be key. With the demands of the market constantly changing, staying ahead means cultivating a robust toolkit of skills that can adapt to various scenarios.

First on the list is analytical thinking. This skill empowers individuals to dissect data, identify trends, and draw meaningful conclusions. Being adept at interpreting numbers and understanding their implications can set one apart in today’s competitive atmosphere. Moreover, strong problem-solving capabilities are necessary; being able to tackle unexpected challenges with innovative solutions is invaluable.

Another crucial aspect is communication. Effectively conveying ideas and findings to colleagues and clients can significantly influence outcomes. This includes not only writing reports but also being proficient in verbal presentation. The ability to articulate complex concepts in an easily digestible manner is essential for collaboration and success.

Furthermore, staying updated with technological advancements is paramount. Familiarity with various software and analytics tools enhances efficiency and provides a competitive edge. Embracing new technology can streamline processes and improve accuracy in assessments.

Lastly, emotional intelligence should not be overlooked. Understanding the human element in finance fosters better relationships and teamwork. Being able to empathize and connect with others can lead to more effective negotiations and successful partnerships.

In summary, cultivating a blend of analytical prowess, effective communication, technological savviness, and emotional awareness will pave the way for success in the dynamic financial terrain ahead. Preparing for the future means honing these essential skills today.