What to Expect for the Child Tax Credit Amount Per Child in 2025

The landscape of financial assistance for families is continually evolving, shaped by new policies and shifting societal needs. It’s essential for parents and guardians to stay informed about the benefits available to them, as these resources can significantly alleviate the cost of raising the younger generation. In the upcoming year, there will be fresh changes designed to support households, making it all the more vital to grasp the details.

For many, the help offered can make a notable difference in daily life, enhancing opportunities and reducing stress. With potential modifications in the structure of such aid, understanding the specifics will provide clarity and enable families to plan effectively. As we delve into the particulars of these initiatives, it becomes clear how beneficial they can be for nurturing younger citizens and ensuring a brighter future.

As we examine these enhancements, it’s also worthwhile to consider the broader impact on family finances. The adjustments can create ripple effects–improving everything from education to healthcare. Let’s explore what this means for households and how to make the most of the support available in the coming year.

The Impact of the 2025 Financial Support Program

In the landscape of economic assistance for families, upcoming adjustments are set to make a significant difference. These changes aim to provide relief and support for households, contributing positively to the overall well-being of young dependents. Such initiatives play a crucial role in fostering a nurturing environment, allowing families to invest in essential needs and future opportunities.

By enhancing the financial backing for caregivers, there will likely be an increase in disposable income, enabling better access to education, healthcare, and extracurricular activities. Parents can focus on what truly matters, such as fostering their children’s growth and development without the constant burden of financial stress. This shift might empower individuals to prioritize long-term investments in their offspring’s future.

Moreover, the broader economy could benefit from these changes. As families experience increased financial stability, there will be a boost in consumer spending, leading to heightened economic activity. Local businesses and service providers could see improved sales as parents feel more confident in their purchasing decisions. In essence, this support program could help create a cycle of positive economic growth, benefiting not just individual households but the community at large.

Ultimately, these enhancements to financial assistance reflect a commitment to supporting families in a meaningful way. By prioritizing the needs of the next generation, society can cultivate a healthier, more prosperous future for all. Through thoughtful policy adjustments, the aim is to build a framework that enables families to thrive and reach their fullest potential.

Eligibility Requirements for Financial Benefits

When looking into options for financial assistance aimed at supporting families, it’s crucial to understand who qualifies for these programs. Various factors come into play, and knowing the specific criteria can help you make informed decisions. This section highlights the important aspects you need to consider to determine if you meet the necessary requirements for receiving this valuable support.

First and foremost, residency plays a significant role. Applicants typically need to be residents of the country during the entire fiscal year. Additionally, they must provide proof of having dependents that meet certain age and relationship stipulations. Being aware of these residency requirements can save you time and effort when filing.

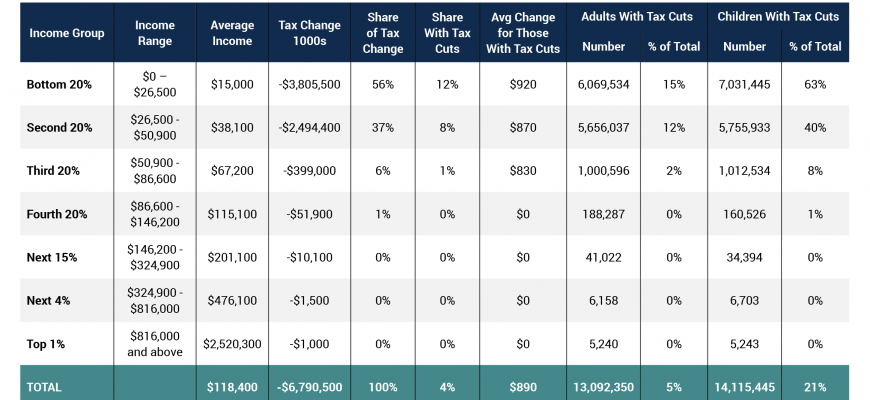

Income limits are another vital consideration. Each program often sets thresholds that determine eligibility based on annual earnings. These limits can vary, so reviewing the latest guidelines is essential. Lower-income families generally find themselves more likely to qualify, but it’s important to check against the specific limits established for the current year.

Lastly, having proper documentation is essential for a smooth application process. Tracking your income, dependent status, and any relevant identification will help lay a solid foundation for your application. Keeping these criteria in mind will pave the way for effectively navigating the financial assistance landscape.

How to Claim Your Benefits

Claiming your financial support for dependents can seem a bit overwhelming, but it doesn’t have to be! Knowing the steps to navigate through the process is key. Whether you’re a first-timer or just need a refresher, understanding the basics helps ensure that you can take full advantage of the available benefits.

First, gather all necessary documents that reflect your family’s situation. This usually includes your income statements, identification numbers, and any forms related to your dependents. Having everything on hand will make the process smoother and quicker. You want to avoid any last-minute scrambles that could delay your application.

Next, determine the appropriate forms to fill out based on your individual circumstances. Depending on how you file–whether it’s online, through a tax software, or with a professional–you’ll need to select the correct paperwork that corresponds to your financial background and family structure.

When filling out the forms, ensure you provide accurate information regarding each dependent. Mistakes can lead to delays or even loss of benefits, so double-checking your entries is a smart move. If you’re using software, it can often guide you through this process and flag any potential errors.

After completing your forms, submit them before the deadline. If you’re unsure of the timeline, checking online for the current year’s filing dates can help you stay on track. Timeliness matters and can make a big difference in when you receive your support.

Finally, keep an eye on your submission status. Most online platforms allow you to check the progress of your application. If you encounter any issues, don’t hesitate to reach out to the relevant support service for assistance. They’re there to help you every step of the way!